Tax Return for 2024

Submitting our tax returns is something that terrifies even us Czechs every year:-) Most of the time however it’s not as complicated as it looks! In some cases, you don’t need to file a tax return at all, and oftentimes your employer will help you do your taxes. Most importantly you need to know if you have the obligation to file a tax return, and whether you can claim any tax reliefs. The following article will walk you through this problem.

Before we get into it, let’s explain a couple of important terms.

The so-called “Růžové prohlášení”, i.e. “pink declaration” (Declaration of the taxpayer liable to personal income tax) is a form that lets you claim a monthly tax relief. If you have more than one employer at the same time, you can only sign this declaration with one of them in a calendar month. If you change employers during the year, you can sign the declaration with your new employer once the old employment ends. When you sign the form, you state which monthly tax reliefs you are entitled to. Your employer will adjust the amount of advance tax paid to the state accordingly.

Advance tax (zálohová daň): if you have signed the pink declaration with your employer, they will pay advance tax on your income. However, as part of the annual tax return, you can claim various tax reliefs or reduce the tax, i.e. there is a good chance that the tax office (finanční úřad, FÚ) will refund some of the advance tax you have paid.

Pay-as-you-earn tax (srážková daň) is an income tax of 15%. The pay-as-you-earn tax is used if the employee has not signed a pink declaration with the employer and his/her gross income does not exceed CZK 10,000. In this case, 15% of your income is automatically deducted and you don’t have to do anything about it. You will most often come across pay-as-you-earn tax with jobs that are not your primary employment, i.e. with an agreement on completing a job (DPP, income up to CZK 10,000) or an agreement on performing work (DPČ, income up to CZK 4,000).

Tax domicile (daňový domicil) determines in which state you are liable to pay taxes, i.e. in which state you are a tax resident. A tax resident of the Czech Republic is someone who resides here for more than 183 days in a year (not necessarily uninterruptedly), has an address here, and the centre of his/ her life interests is in the Czech Republic (lives here with his/her family, is self-employed here, runs a business or is employed). Tax domicile does not depend on your citizenship; the tax office will issue a tax residence certificate upon your request. For more information on tax domicile, see this article by Brno Expat Center.

Who does not have an obligation to file a tax return:

- An employee who has received income from one employer during the year and has paid advance tax on that income can ask the employer to do the annual tax settlement. However, you need to do this no later than 15. 2. 2025. Provide confirmations for all the taxable income, and proof that you‘re entitled to tax reliefs and tax credits (see below). The same applies in case you‘ve been employed with several employers successively during the year. In this case, ask the last employer to do your annual tax settlement.

- A person who has only had income subject to pay-as-you-earn tax during the year (typically a DPP of up to CZK 10,000) and hasn’t had the so-called pink declaration signed anywhere.

- A person who has had income from one, or from several employers successively (taxed by advance tax) and income taxed by pay-as-you-earn tax (typically primary employment relationship + DPP for up to CZK 10,000)

- A self-employed person who paid a flat rate tax during 2024 and did not breach the criteria for a flat rate tax.

TIP: Even if you don’t have an obligation to file a tax return, it can be beneficial, especially if you have a lower income and haven’t claimed tax relief during the year.

Who has an obligation to file a tax return:

- A person who worked for two employers at the same time (even if it was just for a month) and paid advance income tax for both jobs (gross income with each employer was more than CZK 10,000).

- A person whose income other than that from employment (so-called occasional income for which the person does not have a trade licence) exceeded CZK 20,000. This amount means the gross income, before deducting any expenses.

- A person who has a regular rental income.

- A person who has an active trade license but has not paid the flat-rate tax or has breached the flat-rate scheme.

- A person who has income from capital assets (stocks, securities, cryptocurrencies, etc.).

- And other specific cases if you do not meet the conditions for income exemption according to §4, 4a and 4b of Act 586/1992 Coll.

Deadlines and ways of filing

There are three ways to file your tax return:

- by 1. 4. 2025 in a hard copy (in person at the Tax Office or by post)

- by 2.5.2025 in electronic format (via the mojedane.cz portal or via a databox)

- by 1.7.2025 if processed and filed by a tax advisor

You can use either the simplified form or the extended form to file your tax return. The simplified (two-page) form is for taxpayers with income from dependent activities (employment) only. The extended form (four pages) is for entrepreneurs and other taxpayers with multiple incomes. You can also find the form with detailed instructions in English on the tax office’s website, but it should be filled out in Czech!

Attention! If you have a databox, you are obligated to file your tax return in electronic format!

Is there any way I can reduce the tax I pay?

Yes! Every employee is entitled to the basic tax relief on a taxpayer. Other tax reliefs and tax credits depend on whether you are a tax resident of the Czech Republic, i.e. whether you have a certificate of tax domicile in the Czech Republic (explained above).

Attention! Persons staying in the Czech Republic only for the purpose of study or medical treatment are always tax non-residents of the Czech Republic.

Tax resident of the Czech Republic:

- Pays taxes on all his/her income in the Czech Republic, even income from abroad.

- Is entitled to all tax allowances, all tax reliefs and credits.

Tax non-resident of the Czech Republic but a resident of the EU/EEA:

- Is entitled to all tax allowances, all tax reliefs and credits only in case:

- 90% of all of his/her income is earned in the Czech Republic

- he/she files a tax return and attaches a document confirming income from abroad (if any) independently or through a tax advisor

Tax non-resident of the Czech Republic and a non-resident of the EU/EEA:

- Is only entitled to the basic tax relief on a taxpayer.

Deductions (non-taxable part of the tax base): what can you deduct from your tax base?

Under certain conditions, these are:

- interests on a mortgage loan and other similar loans,

- donations for charitable purposes, including free blood or plasma donations (marked as gratuitous transactions on the tax return form),

- pension supplementary insurance premiums,

- private life insurance premiums,

- and others, see § 15, 586/1992 Income Tax Act.

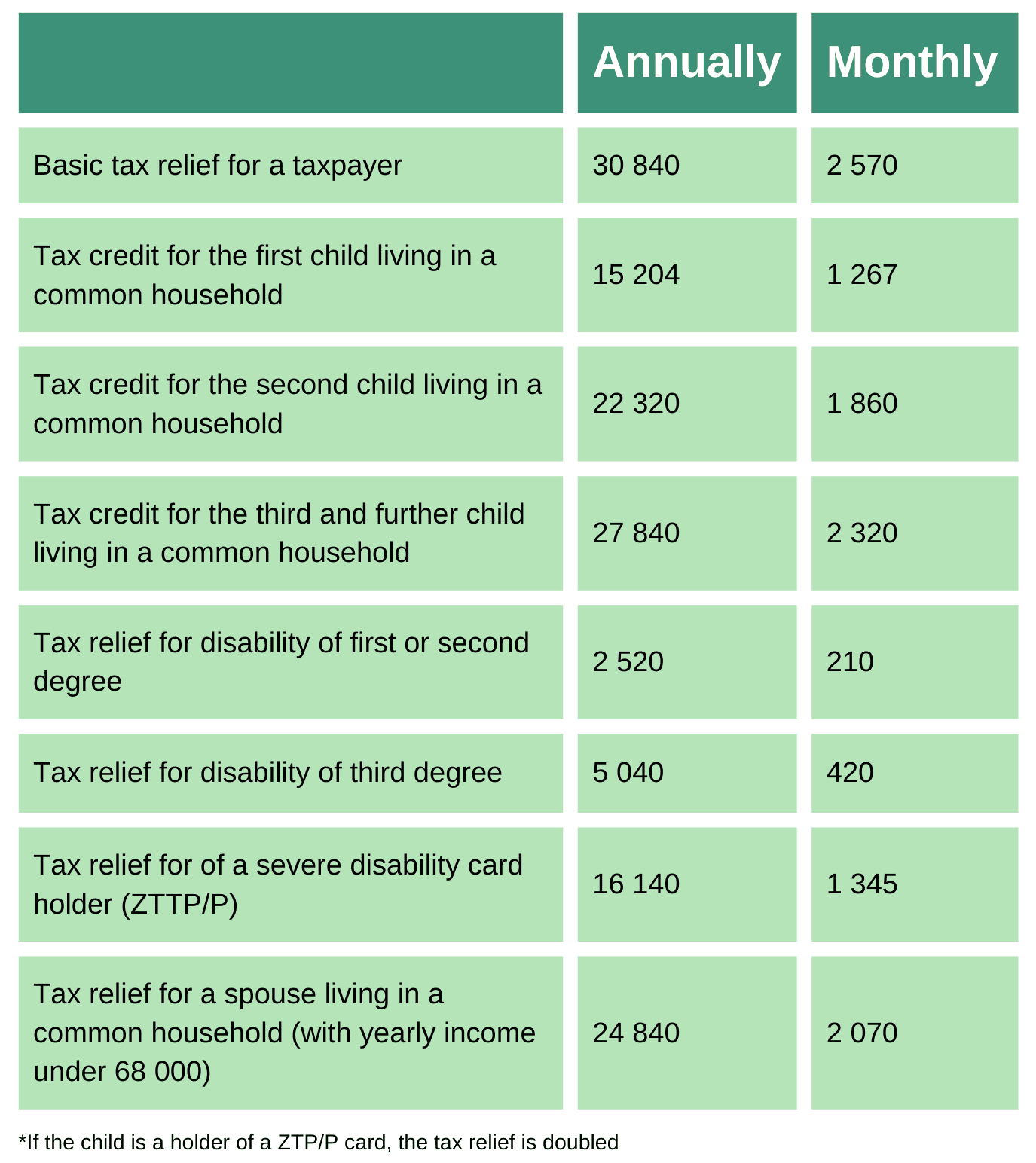

Tax reliefs: what can you deduct from the calculated amount of tax?

For details and conditions, see §35ba, § 35bb, §35bc, 586/1992 Income Tax Act

Every employee and entrepreneur can reduce their taxes by tax reliefs or tax credits. Some of these can already be applied by your employer to your monthly pay (e.g. tax relief for taxpayer/ child), some can only be used after the end of the year in your tax return or the annual tax settlement filed by your employer. You don’t need to submit any proof for tax relief on a taxpayer, but for the rest of tax reliefs you have to provide documents proving you’re entitled to them (your children’s birth certificates, your spouse’s declaration, confirmation from the other taxpayer’s employer, etc.). Therefore, be sure to submit all documents that prove you are entitled to the reliefs along with your tax domicile.

Attention! The dependent spouse must care for a child under 3 years of age. If the spouse cared for the child for only part of the year, the credit is only for the months when the spouse was dependent. If your child/spouse does not live in the same household as you, you cannot claim tax relief for them.

You can complete your tax return online using an online wizard. It will tell you what to fill out in the boxes in a simple form using prompts, and will use series of yes/no questions to see if you will claim any deductions or tax reliefs. At the end of the form, you will see the amount overpaid, which will be refunded to you, or the amount underpaid, which you’ll need to pay to the tax office. You can then print out the completed tax return, sign it and take it to the local tax office according to your address, or you can send it in electronic format using a databox.

In case you have income from several sources (primary employment, DPP, self employment, stocks, rental income, income from abroad, etc.), it is better to contact an accounting firm or a tax advisor who will prepare your tax return once you’ve provided all the documents.

We hope this article has clarified the basic rules for filing (or not) of tax returns. In case you need assistance from an interpreter at the tax office to obtain a tax domicile certificate, you can contact our intercultural workers.

Other articles we recommend to read:

https://portal.gov.cz/en/informace/personal-income-taxes-INF-293